Build Wealth. Live with Purpose. Stay True to Your Faith.

How to Make your Money Work for you, without killing yourself..

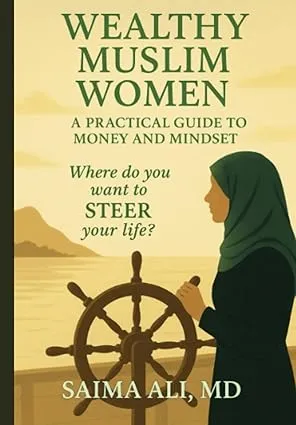

Wealthy Muslim Women: A Practical Guide to Money and Mindset by Dr. Saima Ali. Discover a step-by-step approach to building wealth, investing wisely, and achieving financial freedom. Buy on Amazon

Buy The Book!

Money Mindset & Financial Foundations for Muslim Women. Learn how to create a plan that works for your values. Enroll Free!

Enroll for Free“Tune into the podcast on Spotify”

Wealthy Muslim Women

Introducing Wealthy Muslim Women: Unlocking the Path to Abundance.

Discover the Art of Financial Success, Mindset, and More....

Are you ready to embrace a life of abundance?

At Wealthy Muslim Women, we delve into the secrets of financial prosperity, empowering you to transform your mindset, master your budget, conquer debt, retirement plan, and explore the world of investments.

About Me

I'm Saima— a neurologist, certified life coach, and founder of Wealthy Muslim Women.

I grew up in Pakistan, came to the U.S. for medical school, and graduated with six-figure debt — all mine to repay. I learned the hard way that building wealth isn’t about luck or quick wins; it’s about mastering money, making smart investments, and staying true to your values.

I went from overwhelmed and in debt to financially free, with systems that make my money work for me. Now, I help Muslim women do the same — through my book, podcast, and courses — so they can live with confidence, independence, and purpose.

"Work Smarter, Not Harder"

It's a common expression you’ve probably heard more times than you can count. And the essence of this slogan revolves around what you think about working, not how you do it.

Basically, your definition of work and the outcome (e.g. money) is essentially what shapes how you think about it. So for example, ask yourself...

Is wealth something an average Muslim woman like me can attain? Can I work smarter to acquire more wealth for my family without having to work extra hours or take a second job?

Can the average Muslim woman be wealthy, too? Can a Muslim woman retire as a...millionaire?

Yes you can! You can secure your family’s future by making money work for you, rather than you working for it. Imagine for yourself a life of financial freedom full of wealth.

All it takes is understanding limitations that we've all made up in our minds. It's changing that limiting mindset to one that's limitless and achievable.

Stop questioning yourself when it comes to making financial decisions. Instead, start educating yourself so you can recognize the wealth you have and learn to create wealth with money.

Are you ready to join me on this journey?

Keeping Up With The Joneses

Like most Americans, we get caught up in a vicious cycle of buying the latest, most expensive fad on the market. Capitalism is designed to prey on the average Jane so she feels inclined to buy things she doesn’t need and that are way out of her budget.

It’s all part of the American dream of fitting in: owning things you can’t afford. That fancy house with a heavy mortgage. The luxury car that guzzles more gas than a semi. The phone. The purse. The shoes.

Most Americans also live in debt because of the need to constantly keep up with the Joneses. Falling behind on bills, struggling to pay the mortgage, living paycheck to paycheck is all too common when you’re comparing yourself to what others have.

So, what is the reason behind such a mindset? Lack of self-confidence.

Relying on yourself after Allah is key to managing your life. It paves a way to financial freedom and is the foundation for all your investments, namely yourself. When you learn to invest in yourself, you’ll find many aspects of your life fall into place: family, work, and wealth.

With Wealthy Muslim Women, you learn how to confidently invest in the stock market in a halal way that puts money in your bank and financial freedom in your pocket.

BE THE FIRST TO KNOW

Type in your name and email address to join our mailing list. Get all of the amazing updates on the latest classes and events at Wealthy Muslim Women

Copyright © 2025 Wealthy Muslim Women – All Rights Reserved

Disclosure/Terms of Use: This website exists for educational and mission-related purposes, and is not intended to provide individualized advice, including financial, investment, legal, or accounting. We are not licensed professionals in these realms. Testimonials and examples on this site are from past clients and reflect their experiences. Results vary and are not guaranteed. Any decisions that you make on the basis of any content on this website or our associated assets (communities, social media accounts, events, etc) should be made after your own due diligence and vetting, and consultation of appropriate expertise if relevant. We may receive compensation through clicks to our affiliate programs through this website, or we may receive compensation through advertising and sponsorships from third parties. These help support the existence and mission of the website and its communities, but should be viewed as introductions rather than formal recommendations. To learn more, visit our Terms of Use and Privacy Policy pages.